Your Mainland Company Formation

in Dubai Made Easy

Entrepreneurs and traders select Dubai for their organisation formation because of its funding versatility and strategic market location. A mainland company is a criminal entity registered under the Dubai Economic Department (DED). and ruled by way of the UAE business enterprise law (Federal Law No. 2 of 2015). Dubai is a hastily growing world marketplace with tons of promising funding opportunities. This has significantly contributed to the challenges encountered in forming a mainland organisation in Dubai. Dubai mainland provides better blessings in phrases of business enterprise expansion and funding opportunities as towards the free zones in UAE. Mainland businesses are accredited to exchange somewhere in UAE or wider Gulf Cooperation Council (GCC) states.

How to Form A Company in Dubai Mainland?

This enterprise setup in Dubai mainland is a stepwise undertaking that includes;

- Selection the right organization undertaking – which will determine the type of license.

- Choosing the nearby Sponsor for LLCs or Local carrier agent for Establishments.

- Insurance of initial approval and choice of trade name.

- Preparation of MOA or LSA settlement and notarizing it.

- Acquisition of tenancy contract after discovering a suitable office.

- Getting the extra approvals from the associated government departments.

- Final submission of files to DED and issuing the change license.

The first step in the formation of a mainland agency in Dubai, is deciding on the corporation legal form. This determines the shape of the company and the type of business exercise they can be involved in, the economic branch in Dubai (DED) has over 2000 on hand activities.

1. Commercial license

The Commercial license is the most frequent trade license in Dubai, it consists of all types of commercial activities, it can additionally encompass some professional activities, if approved by the Dubai Economic Department, the things to do should be linked to each other, most investors pick out the accepted trading activity, this allows them to exercise more than one direct buying and selling things to do in one license, and permits them to import and export almost any product to Dubai, without buying and selling of some merchandise which requires approvals from other authorities departments such as jewelry, magazines and newspapers trading, the felony form can be sole institution for locals and GCC nationals or LLC.

2. Professional license

This license type is the easiest to do, it should include professional things to do only, typically new traders go for this type because of the cost, it’s more cost-effective from the different types and you can rapidly trouble the license, all consultancy activities have to take a shape of a professional license, the felony form can be either a sole establishment or a civil agency in case of greater than one investor, this license type is handy to form, amend and cancel, some professional things to do include: Consulting, typing, drawing, and designing.

3. Industrial license

This license is issued for industrial and manufacturing activities, it usually takes a form of an LLC, the area of the license should be a warehouse or a factory, the location can be an office for the first yr if authorized by using DED, Most of the industrial activities require external approvals that include: ministry of economy, civil defense, municipality, and other departments, some industrial things to do include: manufacturing, packaging, filling and

producing of many products. producing of many products.

4. Tourism license

This license kind is issued for tourism things to do only, the shape is commonly an LLC, it requires the approval of The Department of Tourism & Commerce Marketing (DTCM), for the most activities, the requirements consist of an insurance policy, you need to hire an office in Dubai mainland, the minimum area is usually 300 rectangular feet, some tourism activities include: inbound and outbound tours, inn and travel agency.

What are the legal forms of a Dubai mainland company?

1. Sole Establishment

A sole establishment is owned with the aid of a single man or woman mostly referred to as a sole proprietor. The sole proprietor owns a hundred percent of the sole establishment. A corporate body or a crew of humans can’t set up a sole establishment. A sole establishment is accredited to lift out a wide variety of activities in the commercial, industrial and professional sector in Dubai. If the sole proprietor happens not to be a country wide of UAE or GCC, a UAE country wide will be appointed on contract as a Local Agent for the establishment. This local agent will be paid an annual fee for representing the corporation in liaising with the government for licenses and labor card, the Sole institution can appoint one supervisor solely as per DED enterprise regulations, however it can have more than one branched inside Dubai.

Advantages:

- Easy setup and closure

- Sole hazard Bearer and income recipient

- Absolute control

- No personal earnings taxes

- No capital

- Low cost

Disadvantages:

- Unlimited Liability.

- Lack of sufficient resources

- Lack of enough managerial skills

- Lack of business continuity

- No Separate entity

2. One Person Company (LLC):

The one-person restrained liability enterprise is owned by one natural or one company body, it consists of one individual only. It is comparable to the sole institution but it differs in some provisions, the most essential of which is that its liability is confined to the single partner, whereas in the sole-proprietorship the liability is unlimited, a nearby a GCC countrywide can set up and personal a one-person company (LLC), the trade identify of this employer need to by: Shareholder’s name + the pastime + the legal shape + LLC, it can have up to 11 managers, the supervisor can be of any nationality.

Advantages

- Easy setup and closure

- Sole danger Bearer and income recipient

- Absolute control

- No personal profits taxes

- Limited Liability

- Low Cost

Disadvantages

- Lack of sufficient Resources

- Lack of enough managerial skills

- Lack of enterprise continuity

3. Civil Company:

Dubai’s flourishing financial system offers extremely good investment opportunities for Professional buyers searching to establish a civil business enterprise in UAE. A civil agency is a enterprise partnership for professionals. The shareholders of civil enterprise can be of any nationality. If the owners are nationals of a country other than the UAE or the GCC, they require a Local Service Agent (LSA). The Local Service Agent will help in the acquiring of a expert license, visas, labor card and a number different documents from worried authorities. There is no minimal capital requirement for the setup of a civil employer in Dubai, a civil employer can practice consultancy things to do but need to be one hundred percent owned by way of expert partners, it can appoint one manager only as per the DED business regulations.

Advantages

- Easy formation and closure

- Sole chance Bearer and earnings recipient on the partners

- Absolute control

- Medium Cost

Disadvantages

- Unlimited Liability

- Lack of commercial enterprise continuity

- No Separate entity

4. Limited Liability Company (LLC):

The Limited Liability Company is the most frequent prison form in Dubai due to the a number option of buying and selling exercise it provides. LLC is licensed to carry out industrial, commercial, professional and even tourism things to do in Dubai. LLC should have between 2-50 shareholders. 51% share quantity of a Limited Liability Company need to mandatorily be owned by way of a local sponsor or partner who is a UAE national. The shareholder’s legal responsibility is restricted to their extent of share in the company’s capital though investors retain most prison possession of LLC in Dubai, LLCs can exercise any industrial, commercial, expert or tourism activity.

Advantages

- Unlimited visa quota.

- Easy growth of business

- The absence of enterprise interruption by the sponsor or the partners.

- Properties and property would belong to the company, now not the partners.

- Investors are permitted to have credit playing cards and financial institution accounts in Dubai

- Full repatriation of capital and profits

- No personal and capital taxes

- No company taxation

Disadvantages

- Sponsors are required most of the time for monetary activities considering the fact that they own 51% of the agency shares.

- Sponsors are by some means liable for the company management the investor leaves the UAE.

5. Branch of a Foreign Company:

Many overseas companies are trying to find to open branch workplaces in Dubai because of its numerous change benefits. A department of a foreign agency can practice expert activities which includes some industrial and industrial activities with a different permit from the Ministry of Economy. The employer branch basically grant a branding provider for the dad or mum employer and can also be involved in the provision of carrier and merchandise in Dubai. The branch corporation ought to operate under the identify of the mum or dad company and supply the equal services as the guardian company. Foreign corporations require the carrier of a local agent for the formation of a department workplace in Dubai. The Local Agent will liaise with the government for the issuance of alternate licenses and labor permits.

Benefits of A Branch Company:

- No private and capital taxes

- No company taxation

- Full repatriation of capital and profits

- No restriction on currency

- Competitive import duties (5% with many exemptions)

- Considered as and an offshore business enterprise in Dubai

- An effortless group of workers recruitment technique

6. Representative Office:

Foreign companies establish consultant workplaces in Dubai for the sole cause of merchandising their activities. A consultant workplace is now not a business structure in its own, but alternatively a business endeavor that a overseas branch can habits in the promoting of its merchandise and services. A Local Service Agent is required in the formation of the representative office in Dubai. The gotten smaller Local Service Agents represents the company in liaising with the authorities for obtaining licenses. Dubai authorities gives a 100% foreign possession of this kind of establishment. Foreign investors do not require neighborhood sponsor or

partners in the formation of a representative workplace in Dubai.

Representative workplaces in Dubai are allowed to carry out industrial activities of the mother or father company only after

due registrations and allow issuance from the following authorities authorities;

- Dubai Economic Department

- Ministry of Economic and Commerce.

- Chamber of Commerce.

Representative workplace formation in Dubai requires serious paper works and vital decision-making processes.

With our full assist and assistance, your consultant workplace will be up and walking in no time. Our many years

of experience in Dubai mainland commercial enterprise setup will assist us supply you with the satisfactory representative office setup

strategy.

The Required Documents to Set up a Mainland Company in Dubai

For individual Shareholders:

- Passport copy + EID copy of all the shareholders

- NOC from current employer for all nationalities except locals and GCC nationals

- In case the shareholder arrived visit visa, a copy of the visa + entry stamp

For Corporate Shareholders:

- Trade license copy or registration certificate

- Board of resolution for the company to be a shareholder

- All documents must be attested by MOFA and translated to the Arabic language

- Manager passport copy and visa copy

Note: Some nationalities may require a security approval at the time of submission, for these nationalities the

shareholder is required to be present, additionally the shareholder should bring the original passport and 6

months bank statement from the resident country.

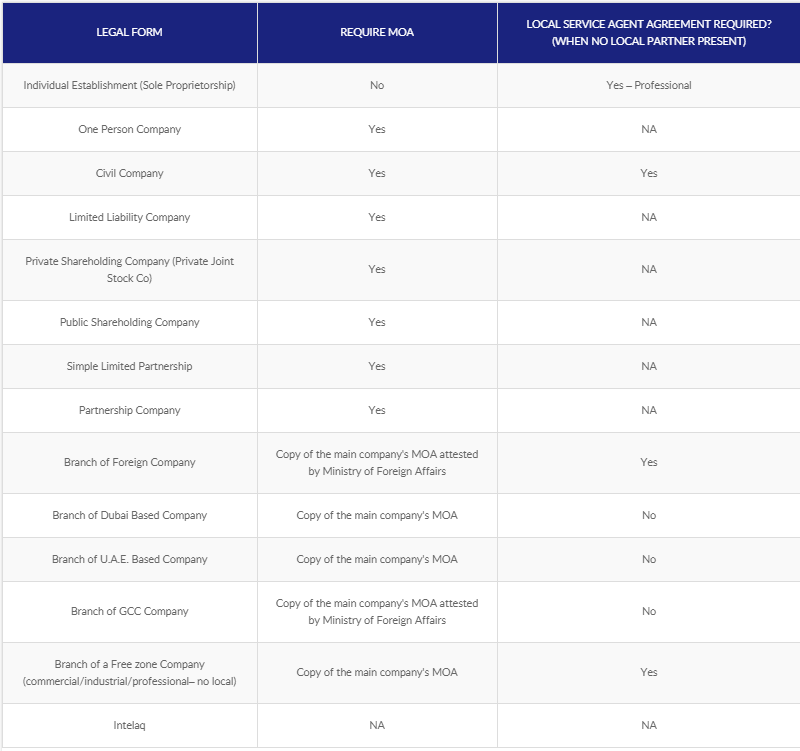

According to the Department of Economic Development (DED) the required Contract for issuing a mainland

license in Dubai is showing below:

Road Map to Starting Your Mainland Company in Dubai

When you decide to begin a department or setup a new company, picking the high-quality commercial enterprise setup marketing consultant in Dubai is just as important as any other manner involved. Our business setup consultancy is a fantastically positioned company with many years of trip and professional professionals who are nicely abreast with the organisation formation procedures. The commercial enterprise setup in Dubai follows a variety of steps which can be achieved in the shortest time body with the appropriate assistance. The setup process includes:

1. Reserving the Trada name

This is a very important element of the commercial enterprise setup process. the high-quality of the title chosen will go a long way in telling your potential customers about your company and the offerings you render. This stage must be undertaken with patience as most top alternate names have been taken or reserved. Picking out a alternate title is an essential thing of the time-honored suggestions essential for the issuance authority.

2. Finding the local sponsor

One of the most necessary components when you decide to start a corporation in Dubai is finding a suitable organisation neighborhood sponsor who is expert and trusted to act as a nominee partner or nearby carrier agent.

3. Issuing of initial approval

This stage ensures the authorities consciousness of your business and the verification of all required documents. All paper files along with passports copies, visa copies and NOC’s are submitted for verification. This stage also entails the signing and submission of application form for approval.

4. Finding a suitable location

Finding an workplace area after the issuance of the preliminary approval is essential for the agency setup in Dubai. Depending on the kind of license obtained, the office region and choices available may vary. In a case the place your license is a mainland license, extra choices such as the business bay and Sheikh Zayed road are available for the taking. The commercial enterprise centers in Dubai grant furnished offices with a rent such as all utility bills.

5. Signing legal contracts

This stage of the process requires all partners worried to sign a partnership agreement which consists of a declaration of the company’s capital, shares and the earnings of each partner. This settlement would be attested at the notary public. This procedure might fluctuate relying on the type of license acquired.

6. Issuing of license

After entirely vetting all submitted archives and success of all requirements, the DED issues the ultimate price voucher. After payments are made, your respectable business license will be issued and you agency can legally operate in Dubai.